Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under §240.14a-12 |

☒ | | | No fee required |

☐ | | | Fee paid previously with preliminary materials |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | 2 |

TIME: | | | |

DATE: | | | |

ACCESS: | | | This year’s annual meeting will be held virtually via live audio webcast on the internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ |

| 1. | To elect |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

| 3. | To approve by |

| 4. | To approve |

| 5. | To approve a proposed A&R Charter, which will amend and restate our current Second Amended and Restated Certificate of |

| a) | add a provision with respect to the automatic conversion of our |

| b) | add a provision to provide for the exculpation of officers as permitted by recent amendments to Delaware law (the “Officer Exculpation Amendment”); and |

| amend the exclusive forum provision (the “Exclusive Forum Amendment”); and |

| 6. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

| 2024 Proxy Statement | | | 3 |

| | | BY ORDER OF OUR BOARD OF DIRECTORS | |

| | |   | |

| | | ||

| | |

| | |

| | |

| | |

| | |

| | |

Proposal 1: Elect Directors | | | The nominees for director will be elected by the affirmative vote of a majority of the votes cast |

Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | | | The affirmative vote of a majority of the votes cast |

| | |

Proposal 3: Approve | | | The affirmative vote of a majority of the votes cast |

Proposal 4: Approve 2024 Employee Stock Purchase Plan | | | The |

Proposal 5: Approval of the A&R Charter, which incorporates: (a) the Class B Conversion Amendment; (b) the Officer Exculpation Amendment; and (c) the Exclusive Forum Amendment | | | For Proposal 5(a) only, the affirmative vote of the holders of at least two-thirds (66 2/3%) of the outstanding shares of Class B Common Stock, voting as For Proposals 5(b) and 5(c) only, the affirmative vote of the holders of a majority of the total voting power of all the then-outstanding shares of stock of the Company entitled to vote for this proposal is required to approve the Officer Exculpation Amendment and the Exclusive Forum Amendment. Abstentions will have no effect on the results of this vote. |

| 2024 Proxy Statement | | | 11 |

| | |

Name and Address of Beneficial Owner | | | Number of shares of Class A Common Stock | | | % | | | Number of shares Class B Common stock | | | % | | | % of Total Voting Power** |

Directors and Executive Officers: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(1)(2) | | | 10,011,285 | | | 5.8 | | | 26,426,937 | | | 100 | | | 76.8 |

Larry Robbins(1)(3) | | | 17,330,506 | | | 9.8 | | | — | | | — | | | 1.8 |

Dawn Carfora(1)(4) | | | 16,394 | | | * | | | — | | | — | | | * |

Elazer Edelman, M.D., Ph.D.(1)(5) | | | 5,032 | | | * | | | — | | | — | | | * |

John Hammergren(1)(6) | | | 124,484 | | | * | | | — | | | — | | | * |

Gianluca Pettiti(1)(7) | | | 22,399 | | | * | | | — | | | — | | | * |

S. Louise Phanstiel(1)(8) | | | 64,434 | | | * | | | — | | | — | | | * |

Erica Schwartz, MD, JD, MPH(1) | | | — | | | — | | | — | | | — | | | — |

Todd M. Fruchterman, M.D., Ph.D.(1)(9) | | | 757,398 | | | * | | | — | | | — | | | * |

Stephanie Fielding(1)(10) | | | 202,295 | | | * | | | — | | | — | | | * |

Stacey Pugh(1)(11) | | | 64,497 | | | * | | | — | | | — | | | * |

Darius Shahida(1)(12) | | | 721,843 | | | * | | | — | | | — | | | * |

Andrei G. Stoica, Ph.D.(1) | | | — | | | — | | | — | | | — | | | — |

Laurent Faracci(1)(13) | | | 1,580,802 | | | * | | | — | | | — | | | * |

| | | | | | | | | | | ||||||

All Current Directors and Executive Officers of the Company as a Group (15 Individuals)(14) | | | 29,991,082 | | | 16.7 | | | 26,426,937 | | | 100 | | | 78.7 |

Five Percent Holders: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(1)(2) | | | 10,011,285 | | | 5.8 | | | 26,426,937 | | | 100 | | | 76.8 |

Fosun Industrial Co., Limited(15) | | | 10,716,630 | | | 6.2 | | | — | | | — | | | 1.5 |

Glenview Capital Management(3) | | | 17,330,506 | | | 9.8 | | | — | | | — | | | 1.8 |

FMR LLC(16) | | | 16,111,158 | | | 9.3 | | | — | | | — | | | 2.3 |

Blackrock, Inc.(17) | | | 8,801,660 | | | 5.1 | | | — | | | — | | | 1.3 |

The Vanguard Group(18) | | | 13,179,593 | | | 7.6 | | | — | | | — | | | 1.9 |

Name and Address of Beneficial Owner(1) | | | Number of shares of Class A Common Stock | | | % | | | Number of shares of Class B Common Stock | | | % | | | % of Total Voting Power** |

| Directors and Executive Officers: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(2) | | | 10,479,298 | | | 5.7 | | | 26,426,937 | | | 100 | | | 75.6 |

Larry Robbins(3) | | | 17,409,154 | | | 9.5 | | | — | | | — | | | 2.4 |

Dawn Carfora(4) | | | 95,042 | | | * | | | — | | | — | | | — |

Elazer Edelman, M.D., Ph.D.(5) | | | 84,974 | | | * | | | — | | | — | | | — |

S. Louise Phanstiel(6) | | | 143,082 | | | * | | | — | | | — | | | — |

Erica Schwartz, M.D., J.D., M.P.H.(7) | | | 64,167 | | | * | | | — | | | — | | | — |

Heather C. Getz(8) | | | 679,000 | | | * | | | — | | | — | | | * |

Andrei G. Stoica, Ph.D.(9) | | | 477,715 | | | * | | | — | | | — | | | * |

Joseph DeVivo(10) | | | 1,610,000 | | | * | | | — | | | — | | | * |

| | | | | | | | | | | | |||||

All Current Directors and Executive Officers of the Company as a Group (10 Individuals)(11) | | | 31,042,432 | | | 16.9 | | | 26,426,937 | | | 100 | | | 78.5 |

| Five Percent Holders: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(2) | | | 10,479,298 | | | 5.7 | | | 26,426,937 | | | 100 | | | 75.6 |

Entities Affiliated with Glenview Capital Management(3) | | | 17,409,154 | | | 9.5 | | | — | | | — | | | 2.4 |

Blackrock, Inc.(12) | | | 10,330,167 | | | 5.6 | | | — | | | — | | | 1.4 |

ARK Investment Management LLC(13) | | | 13,688,534 | | | 7.4 | | | — | | | — | | | 1.9 |

Fosun Industrial Co., Limited(14) | | | 10,716,630 | | | 5.8 | | | — | | | — | | | 1.5 |

* | Indicates beneficial ownership of less than 1%. |

** | Percentage of total voting power represents voting power with respect to all outstanding shares of our Class A common stock and our Class B common stock as a single class. Each share of our Class B common stock is entitled to 20 votes per share and each share of our Class A common stock is entitled to one vote per share. |

(1) | Unless otherwise indicated, the business address of each of these individuals is c/o Butterfly Network, Inc., |

(2) | Consists of (i) |

| 2024 Proxy Statement | | | 13 |

(3) | Consists of (i) |

(4) | Consists of (i) 73,397 shares of |

(5) | Consists of (i) 63,329 shares of |

(6) | Consists of |

| Consists of |

(8) | Consists of (i) 364,420 shares of Class A common stock, |

(9) | Consists of (i) 396,535 shares of Class A common stock and (ii) 81,180 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. |

(10) | Consists of |

(11) |

(12) |

(13) | Information is based on the Schedule 13G/A filed by ARK Investment Management LLC on January 29, 2024, consists of shares of |

| | |

| | | | | |||

Executive Officers: | | | | | ||

| | | | | President, Chief Executive Officer and Chairperson of the Board of Directors | ||

| | | | | Chief Financial & Operations Officer and Corporate Secretary | ||

| | | | | Chief | ||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

| | | | | |||

Erica Schwartz, M.D., J.D., M.P.H. | | | | | Director |

| | 60 | | | Founder and Director |

| 2024 Proxy Statement | | | 15 |

| 2024 Proxy Statement | | | 16 |

| 2024 Proxy Statement | | | 17 |

| 2024 Proxy Statement | | | 18 |

| 2024 Proxy Statement | | | 19 |

| 2024 Proxy Statement | | | 20 |

| 2024 Proxy Statement | | | 21 |

| 2024 Proxy Statement | | | 22 |

| | | 23 |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($)(1) | | | Stock Awards ($)(2) | | | Option Awards ($)(3) | | | All Other Compensation ($) | | | Total ($) |

Joseph DeVivo, Chief Executive Officer(4) | | | 2023 | | | 588,942 | | | 1,101,712 | | | 9,117,333 | | | — | | | 630(5) | | | 10,808,618 |

Jonathan M. Rothberg, Former Interim Chief Executive Officer(6) | | | 2023 | | | — | | | — | | | — | | | — | | | 217,351(7) | | | 217,351 |

| | 2022 | | | — | | | — | | | — | | | — | | | 217,498 | | | 217,498 | ||

Heather Getz Chief Financial Officer | | | 2023 | | | 535,500 | | | 374,710(8) | | | 2,390,400 | | | — | | | 7,510(9) | | | 3,308,120 |

| | 2022 | | | 316,667 | | | 255,464 | | | 2,249,998 | | | 749,458 | | | 401,897 | | | 3,973,484 | ||

Andrei Stoica, Chief Technology Officer | | | 2023 | | | 484,500 | | | 197,600 | | | 1,545,600 | | | — | | | 23,116(10) | | | 2,250,816 |

| | 2022 | | | 475,000 | | | 199,500 | | | 1,714,139 | | | — | | | 319,131 | | | 2,707,770 |

| The amounts in this column for 2023 reflect cash bonuses earned in 2023 and paid in 2024 as well as a $500,000 sign-on bonus paid to Mr. DeVivo when he commenced employment with us. |

(2) | The amounts in this column reflect the aggregate grant date fair value of stock awards granted during 2023 and 2022, respectively, computed in accordance with Accounting Standards Codification, or ASC, Topic 718, Compensation-Stock Compensation, or Topic 718. Such grant date fair values do not take into account any estimated forfeitures. Details as to the assumptions used to calculate the fair value of the option awards are included in Note 11 “Equity Incentive Plan” to our consolidated audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The grant date fair value of each time-based RSU award is measured based on the closing price of our Class A common stock on the grant date. For performance-based RSU awards granted on April 24, 2023 and July 13, 2023 to Mr. DeVivo and Ms. Getz, respectively, the vesting conditions relating to each such awards are considered market conditions and not financial performance conditions. Accordingly, there is no grant date fair value below or in excess of the amount reflected in the table above for Mr. DeVivo and Ms. Getz that could be calculated and disclosed based on achievement of the underlying market condition. The grant date fair value of such performance-based awards with a market condition, measured utilizing a Monte Carlo simulation as of the date of grant, was $3,333,333 and $408,000 for each award, respectively. The amounts reported in this column do not necessarily correspond to the actual value recognized or that may be recognized by the NEOs. |

(3) | The amounts in this column reflect the aggregate grant date fair value of the option awards granted during 2022, computed in accordance with Topic 718, using the Black-Scholes option-pricing model. Such grant date fair values do not take into account any estimated forfeitures. Details as to the assumptions used to calculate the fair value of the option awards are included in Note 11 “Equity Incentive Plan” to our consolidated audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These amounts do not necessarily correspond to the actual value recognized or that may be recognized by the NEOs. |

(4) | Mr. DeVivo commenced employment with us on April 24, 2023. |

(5) | Amounts reported in this column represent $630 of cell phone reimbursements. |

(6) | Dr. Rothberg served as our Interim Chief Executive Officer from December 31, 2022 to April 24, 2023 and received no additional compensation for this role. In connection with Mr. DeVivo’s appointment as our President and Chief Executive Officer, effective as of the April 24, 2023, Mr. Rothberg stepped down as Interim President and Chief Executive Officer as of that same date and continued to serve as a director of our Board. Dr. Rothberg received no additional compensation in connection with his role as Interim President and Chief Executive Officer. Following April 24, 2023, Dr. Rothberg continued to serve as a director of our Board. |

(7) | Amounts reported in this column represent $67,352 of director fees and $149,999 relating to a RSU award granted to Dr. Rothberg in connection with his services as a director in 2023. Dr. Rothberg's fees are partially prorated as a result of his stepping down as Chairperson of the Nominating and Corporate Governance Committee in December 2023. The amount in this column relating to Dr. Rothberg’s RSU award reflects the aggregate grant date fair value of the stock award granted during 2023 computed in accordance with Topic 718. Such grant date fair value does not take into account any estimated forfeitures. The amount reported with respect to Dr. Rothberg’s RSU award does not necessarily correspond to the actual value recognized or that may be recognized by him. |

(8) | Excludes an amount of $21,290, which represents a prorated portion attributable to 2022 of an additional discretionary bonus paid to Ms. Getz in 2023 in connection with her services to the Office of the Chief Executive Officer. |

(9) | Amounts reported in this column represent $910 of cell phone reimbursements and $6,600 of 401(k) plan employer match contributions. |

(10) | Amounts reported in this column represent $910 of cell phone reimbursements, $15,606 of tax gross-ups and reimbursements, and $6,600 of 401(k) plan employer match contributions. |

| 2024 Proxy Statement | | | |

24 |

| Name | | | 2023 Base Salary |

| | | ||

| Heather Getz | | | $600,000 |

| Andrei Stoica, Ph.D. | | | $494,000 |

| | | ||

| (2) | Dr. Rothberg served as our Interim Chief Executive Officer effective December 31, 2022 to April 24, 2023 and received no additional compensation for this role. |

Name | | | 2021 Target Bonus (% of Base Salary) | | | 2021 Target Bonus ($) |

Todd M. Fruchterman, M.D., Ph.D. | | | 100% | | | $750,000 |

Stephanie Fielding | | | 50% | | | $200,000 |

Stacey Pugh | | | 70% | | | $336,000 |

Darius Shahida | | | 50% | | | $200,000 |

Andrei Stoica, Ph.D. | | | 50% | | | $220,000 |

Laurent Faracci | | | 100% | | | $600,000 |

| Name | | | 2023 Target Bonus (% of Base Salary) | | | 2023 Target Bonus ($) |

| Joseph DeVivo | | | 125% | | | $1,093,750 |

| Heather Getz | | | 70% | | | $420,000 |

| Andrei Stoica, Ph.D. | | | 50% | | | $247,000 |

Jonathan M. Rothberg, Ph.D.(1) | | | — | | | — |

| (1) | Dr. Rothberg was not bonus eligible for 2022 or 2023 and did not receive any bonus for his services as Interim Chief Executive Officer. |

Name | | | Target Bonus Opportunity | | | Annual Cash Incentive Earned | | | % of Target |

Todd M. Fruchterman, M.D., Ph.D. | | | 100% | | | $684,247(1) | | | 100% |

Stephanie Fielding | | | 50% | | | $150,000(2) | | | 75% |

Stacey Pugh | | | 70% | | | $267,879(3) | | | 100% |

Darius Shahida | | | 50% | | | $200,000 | | | 100% |

Andrei Stoica, Ph.D. | | | 50% | | | $99,452(4) | | | 100% |

Laurent Faracci | | | 100% | | | N/A | | | N/A |

| | |

| Name | | | Target Bonus Opportunity | | | Annual Cash Incentive Earned | | | % of Target |

| Joseph DeVivo | | | 125% | | | $601,712 | | | 80% |

| Heather Getz | | | 70% | | | $336,000 | | | 80% |

| Andrei Stoica, Ph.D. | | | 50% | | | $197,600 | | | 80% |

Jonathan M. Rothberg, Ph.D.(1) | | | — | | | — | | | — |

| (1) | Dr. Rothberg served as our Interim Chief Executive Officer from December 31, 2022 to April 24, 2023 and received no additional compensation for this role. |

Award Type | | | Description / Objective |

| | | • Vest over a | |

| | | • Realized value linked to share price while maintaining retentive glue during times of volatility | |

Performance Stock Units | | | • Awarded to |

| | | 2021 Equity Awards at Grant Date | | | Total Value | | | Intrinsic Value at 12/31/2021 | ||||||||||||||||

| | | Stock Options | | | Restricted Stock Units | | | Performance Stock Units | | |||||||||||||||

Name | | | # | | | Value | | | # | | | Value | | | # | | | Value | | |||||

Todd M. Fruchterman, M.D., Ph.D. | | | 1,744,442 | | | $12,586,305 | | | 1,038,300 | | | $15,875,607 | | | 92,147 | | | $1,149,995 | | | $29,611,906 | | | $7,562,690 |

Stephanie Fielding | | | 0 | | | $0 | | | 0 | | | $0 | | | 0 | | | $0 | | | $0 | | | — |

Stacey Pugh | | | 91,853 | | | $568,826 | | | 207,660 | | | $4,585,133 | | | 46,074 | | | $575,004 | | | $5,728,962 | | | $1,697,480 |

Darius Shahida | | | 0 | | | $0 | | | 0 | | | $0 | | | 0 | | | $0 | | | $0 | | | — |

Andrei Stoica, Ph.D. | | | 121,771 | | | $662,844 | | | 61,798 | | | $660,003 | | | 0 | | | $0 | | | $1,322,847 | | | $413,368 |

Laurent Faracci | | | 0 | | | $0 | | | 0 | | | $0 | | | 0 | | | $0 | | | $0 | | | — |

| 2024 Proxy Statement | | | 26 |

| 2024 Proxy Statement | | | 27 |

Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | All Other Compensation ($)(3) | | | Total ($) |

Todd Fruchterman, Chief Executive Officer(4) | | | 2021 | | | 687,500 | | | 3,272,247 | | | 17,025,602 | | | 12,586,305 | | | 1,244,510 | | | 34,816,164 |

| | 2020 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2019 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Stephanie Fielding, Chief Financial Officer(5) | | | 2021 | | | 400,000 | | | 355,000 | | | — | | | — | | | — | | | 755,000 |

| | 2020 | | | 194,318 | | | 25,000 | | | — | | | 1,751,250 | | | — | | | 1,970,568 | ||

| | 2019 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Stacey Pugh, Chief Commercial Officer(6) | | | 2021 | | | 380,000 | | | 417,879 | | | 5,160,136 | | | 568,826 | | | 168,334 | | | 6,695,175 |

| | 2020 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2019 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Darius Shahida, Chief Strategy Officer and Chief Business Development Officer | | | 2021 | | | 400,000 | | | 1,230,000 | | | — | | | — | | | — | | | 1,630,000 |

| | 2020 | | | 400,000 | | | — | | | 4,880,010 | | | 583,697 | | | — | | | 5,863,707 | ||

| | 2019 | | | 203,125 | | | 200,000 | | | — | | | — | | | 10,500 | | | 413,625 | ||

Andrei Stoica, Chief Technology Officer(7) | | | 2021 | | | 183,333 | | | 749,452 | | | 660,002 | | | 662,844 | | | 165,126 | | | 2,420,757 |

| | 2020 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2019 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Laurent Faracci, Former Chief Executive Officer(8) | | | 2021 | | | 25,000 | | | — | | | — | | | — | | | 3,516,800 | | | 3,541,800 |

| | 2020 | | | 450,000 | | | 150,000 | | | — | | | 13,264,361 | | | 321,589 | | | 14,185,950 | ||

| | 2019 | | | — | | | — | | | — | | | — | | | — | | | — |

Name | | | Grant Date | | | Estimated Future Payouts Under Equity Incentive Plan Awards(1) | | | All Other Stock Awards: Number of Shares of Stock or Units (#) | | | All Other Option Awards: Number of Securities Underlying Options (#) | | | Exercise or Base Price of Option Awards ($/Sh)(2) | | | Grant Date Fair Value of Stock and Option Awards(3) | ||||||

| | Threshold (#) | | | Target (#) | | | Maximum (#) | | ||||||||||||||||

Todd Fruchterman, Chief Executive Officer | | | 7/12/2021 | | | — | | | — | | | — | | | — | | | 24,036 | | | 12.48 | | | $150,366 |

| | 2/1/2021 | | | — | | | — | | | — | | | — | | | 1,557,450 | | | 15.29 | | | $11,431,262 | ||

| | 7/12/2021 | | | — | | | — | | | — | | | — | | | 162,956 | | | 12.48 | | | $1,004,676 | ||

| | 7/12/2021 | | | 46,073 | | | 92,147 | | | 184,294 | | | — | | | — | | | — | | | $1,149,995 | ||

| | 2/1/2021 | | | — | | | — | | | — | | | 1,038,300 | | | — | | | — | | | $15,875,607 | ||

Stephanie Fielding, Chief Financial Officer | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Stacey Pugh, Chief Commercial Officer | | | 7/12/2021 | | | — | | | — | | | — | | | — | | | 27,864 | | | 12.48 | | | $174,313 |

| | 7/12/2021 | | | — | | | — | | | — | | | — | | | 63,989 | | | 12.48 | | | $394,513 | ||

| | 7/12/2021 | | | 23,037 | | | 46,074 | | | 92,148 | | | — | | | — | | | — | | | $575,004 | ||

| | 2/12/2021 | | | — | | | — | | | — | | | 207,660 | | | — | | | — | | | $4,585,133 | ||

Darius Shahida, Chief Strategy Officer and Chief Business Development Officer | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

Andrei Stoica, Chief Technology Officer | | | 7/19/2021 | | | — | | | — | | | — | | | — | | | 37,452 | | | 10.68 | | | $203,969 |

| | 7/19/2021 | | | — | | | — | | | — | | | — | | | 84,319 | | | 10.68 | | | $458,875 | ||

| | 7/19/2021 | | | — | | | — | | | — | | | 61,798 | | | — | | | — | | | $660,003 | ||

Laurent Faracci, Former Chief Executive Officer | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | | Option Awards | | Stock Awards | |||||||||||||||||||||||||||||||||||||||||||||||||

Name | | Grant Date | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Option Exercise Price ($) | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) | | Grant Date | | Number of Securities Underlying Unexercised Options (#) Exercisable | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | Option Exercise Price ($) | | Option Expiration Date(1) | | Number of Shares or Units of Stock That Have Not Vested (#) | | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) | ||||||||||||||||||

Todd Fruchterman, Chief Executive Officer | | | 7/12/2021 | | — | | 24,036(3) | | 12.48 | | 7/11/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||

| | 2/1/2021 | | — | | 1,557,450(4) | | 15.29 | | 2/1/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 7/12/2021 | | — | | 162,596(5) | | 12.48 | | 7/11/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 7/12/2021 | | — | | — | | — | | — | | — | | — | | 92,147(6) | | 616,463 | |||||||||||||||||||||||||||||||||||||

| | 2/1/2021 | | — | | — | | — | | — | | 1,038,300(7) | | 6,946,227 | | — | | — | |||||||||||||||||||||||||||||||||||||

Stephanie Fielding, Chief Financial Officer | | | 12/17/2020 | | 9,728(8) | | 16,229 | | 9.40 | | 12/17/2030 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||

| | 12/17/2020 | | 136,279(9) | | 227,126 | | 9.40 | | 12/17/2030 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 12/17/2020 | | — | | — | | — | | — | | 97,341(10) | | 651,211 | | — | | — | |||||||||||||||||||||||||||||||||||||

Stacey Pugh, Chief Commercial Officer | | | 7/12/2021 | | — | | 27,844(11) | | 12.48 | | 7/11/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||

| | 7/12/2021 | | — | | 63,989(12) | | 12.48 | | 7/11/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 7/12/2021 | | — | | — | | — | | — | | — | | — | | 46,074(13) | | 308,235 | |||||||||||||||||||||||||||||||||||||

| | 2/12/2021 | | — | | — | | — | | — | | 207,660(14) | | 1,389,245 | | — | | — | |||||||||||||||||||||||||||||||||||||

Darius Shahida, Chief Strategy Officer and Chief Business Development Officer | | | 1/16/2018 | | 155,745 | | — | | 2.48 | | 1/16/2028 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||

| | 9/18/2018 | | 129,752(15) | | 25,993 | | 4.16 | | 9/18/2028 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 1/21/2020 | | 160,063(16) | | 47,597 | | 4.84 | | 1/21/2030 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 12/17/2020 | | — | | — | | — | | — | | 259,576(17) | | 1,736,563 | | — | | — | |||||||||||||||||||||||||||||||||||||

Joseph DeVivo, Chief Executive Officer | | | 4/24/2023(3) | | — | | — | | — | | — | | 1,600,000 | | 1,728,000 | | — | | — | |||||||||||||||||||||||||||||||||||

| | 4/24/2023(4) | | — | | — | | — | | — | | — | | — | | 1,600,000 | | 1,728,000 | |||||||||||||||||||||||||||||||||||||

Jonathan M. Rothberg, Former Interim Chief Executive Officer | | | 2/16/2021(5) | | — | | — | | — | | — | | 4,387 | | 4,738 | | — | | — | |||||||||||||||||||||||||||||||||||

| | 7/1/2021 | | 21,645 | | — | | 14.25 | | 6/30/2031 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 6/20/2023(6) | | — | | — | | — | | — | | 65,789 | | 71,052 | | — | | — | |||||||||||||||||||||||||||||||||||||

Heather Getz, Chief Financial Officer | | | 5/2/2022(7) | | 124,653 | | 190,262 | | 3.58 | | 5/1/2032 | | — | | — | | — | | — | |||||||||||||||||||||||||||||||||||

| | 5/2/2022(8) | | — | | — | | — | | — | | 471,368 | | 509,077 | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 3/1/2023(9) | | — | | — | | — | | — | | 142,500 | | 153,900 | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 3/1/2023(10) | | — | | — | | — | | — | | 600,000 | | 648,000 | | — | | — | |||||||||||||||||||||||||||||||||||||

| | 7/13/2023(11) | | — | | — | | — | | — | | — | | — | | 200,000 | | 216,000 | |||||||||||||||||||||||||||||||||||||

Andrei Stoica, Chief Technology Officer | | | 7/19/2021 | | — | | 37,452(18) | | 10.68 | | 7/18/2031 | | — | | — | | — | | — | | | 7/19/2021(12) | | 68,496 | | 53,275 | | 10.68 | | 7/18/2031 | | — | | — | | — | | — | ||||||||||||||||

| | 7/19/2021 | | — | | 84,319(19) | | 10.68 | | 7/18/2031 | | — | | — | | — | | — | | 7/19/2021(13) | | — | | — | | — | | — | | 27,037 | | 29,200 | | — | | — | |||||||||||||||||||

| | 7/19/2021 | | — | | — | | — | | — | | 61,798(20) | | 413,429 | | — | | — | | 3/4/2022(14) | | — | | — | | — | | — | | 129,310 | | 139,655 | | — | | — | |||||||||||||||||||

Laurent Faracci, Former Chief Executive Officer | | 4/23/2020 | | 1,580,802 | | — | | 4.84 | | 1/23/2026 | | — | | — | | — | | — | ||||||||||||||||||||||||||||||||||||

Andrei Stoica, Chief Technology Officer | | 3/22/2022(15) | | — | | — | | — | | — | | 37,357 | | 40,346 | | — | | — | ||||||||||||||||||||||||||||||||||||

| | 3/1/2023(16) | | — | | — | | — | | — | | 95,000 | | 102,600 | | — | | — | |||||||||||||||||||||||||||||||||||||

| | | 3/1/2023(17) | | — | | — | | — | | — | | 500,000 | | 540,000 | | — | | — | ||||||||||||||||||||||||||||||||||||

(1) | All |

(2) | The market value of the stock awards is based on the closing price of our Class A common stock of |

(3) | The shares underlying this |

(4) | The |

| | |

| | | Option Awards | | | Stock Awards | |||||||

Name | | | Number of Shares Acquired on Exercise (#) | | | Value Realized on Exercise ($)(1) | | | Number of Shares Acquired on Vesting (#) | | | Value Realized on Vesting ($)(2) |

Todd Fruchterman, Chief Executive Officer | | | — | | | — | | | — | | | — |

Stephanie Fielding, Chief Financial Officer | | | — | | | — | | | 32,446 | | | 236,207 |

Stacey Pugh, Chief Commercial Officer | | | — | | | — | | | — | | | — |

Darius Shahida, Chief Strategy Officer and Chief Business Development Officer | | | — | | | — | | | 259,574 | | | 1,889,699 |

Andrei Stoica, Chief Technology Officer | | | — | | | — | | | — | | | — |

Laurent Faracci, Former Chief Executive Officer | | | — | | | — | | | — | | | — |

(5) | The shares underlying this RSU vested as to 33% of the award on February 16, 2022, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Dr. Rothberg’s continued service through the applicable vesting dates. |

(6) | The shares underlying this RSU vest as to 100% of the award on the date of the 2024 annual meeting of Company’s stockholders, subject to Dr. Rothberg’s continued service through the applicable vesting date. |

(7) | The shares underlying this option vestvested as to 25% of the award on May 2, 2023, with the remainder of the award vesting in 36 equal monthly installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(8) | The shares underlying this RSU vested as to 25% of the award on May 2, 2023, with the remainder of the award vesting in 3 equal annual installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(9) | The shares underlying this RSU vested as to 50% of the award on July 1, 2023, with the remainder of the award vesting on January 1, 2024, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(10) | The shares underlying this RSU vest as to 33% of the award on March 1, 2024, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(11) | This award vests based on market conditions and a service condition. 33% shall vest upon the achievement of a price for the Class A common stock equal to or exceeding $3.00 per share, 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or exceeding $4.50 per share, and 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or exceeding $6.00 per share. In each case, the closing stock price for 20 consecutive trading days must equal or exceed the share price targets, and provided such share price is achieved prior to the fifth anniversary following the grant date. Ms. Getz must continue to have a service relationship with the Company on the applicable vesting dates to vest in any portion of her RSU award. |

(12) | The shares underlying this option vested as to 25% of the award on September 30, 2022, with the remainder of the award vesting in 36 equal monthly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(13) | The shares underlying this RSU vested as to 25% of the award on September 30, 2022, with the remainder of the award vesting in 12 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(14) | The shares underlying this RSU vested as to 33% of the award on March 4, 2023, with the remainder of the award vesting in 8 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(15) | The shares underlying this RSU vested as to 33% of the award on March 22, 2023, with the remainder of the award vesting in 8 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(16) | The shares underlying this RSU vested as to 50% of the award on July 1, 2023, with the remainder of the award vesting on January 1, 2024, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(17) | The shares underlying this RSU vested as to 33% of the award on March 1, 2024, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

| 2024 Proxy Statement | | | 29 |

| (i) | any person or group of persons (other than us or our affiliates) becomes the owner, directly or indirectly, of our securities representing more than 50% of the combined voting power of our then outstanding voting securities (the “Outstanding Company Voting Securities”) (but excluding any bona fide financing event in which securities are acquired directly from us); or |

| (ii) | the consummation of a merger or consolidation of us with any other corporation, other than a merger or consolidation (i) that results in the Outstanding Company Voting Securities immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the Outstanding Company Voting Securities (or such surviving entity or, if we or the entity surviving such merger is then a subsidiary, the ultimate parent thereof) outstanding immediately after such merger or consolidation, or (ii) immediately following which the individuals who comprise the |

| (iii) | the sale or disposition by us of all or substantially all of our assets, other than (i) a sale or disposition by us of all or substantially all of our assets to an entity, at least 50% of the combined voting power of the voting securities of which are owned directly or indirectly by our stockholders following the completion of such transaction in substantially the same proportions as their ownership of us immediately prior to such sale or (ii) a sale or disposition of all or substantially all of our assets immediately following which the individuals who comprise the |

| 2024 Proxy Statement | | | 30 |

| (iv) | provided that with respect to Sections (i), (ii) and (iii) above, a transaction or series of integrated transactions will not be deemed a Change in Control (A) unless the transaction qualifies as a change in control within the meaning of Section 409A of the Code, or (B) if following the conclusion of the transaction or series of integrated transactions, the holders of our Class B Common Stock immediately prior to such transaction or series of transactions continue to have substantially the same proportionate voting power in an entity which owns all or substantially all of our assets immediately following such transaction or series of transactions. |

| | |

Dr. Fruchterman | | | Termination by the Company without Cause or by the Executive for Good Reason ($) | | | Termination because of Death or Disability ($) | | | Termination by the Company without Cause or by the Executive for Good Reason Within 3 Months Before or 24 Months Following a Change in Control ($) |

Severance benefits: | | | | | | | |||

Lump sum payment | | | 1,500,000 | | | — | | | 3,000,000 |

Healthcare benefits | | | 16,800 | | | — | | | 33,600 |

Acceleration of equity awards: | | | | | | | |||

Market value of equity vesting on termination(1) | | | 6,946,227 | | | 3,473,114 | | | 6,946,227 |

Total Payment | | | 8,463,027 | | | 3,473,114 | | | 9,963,027 |

| | |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(1) |

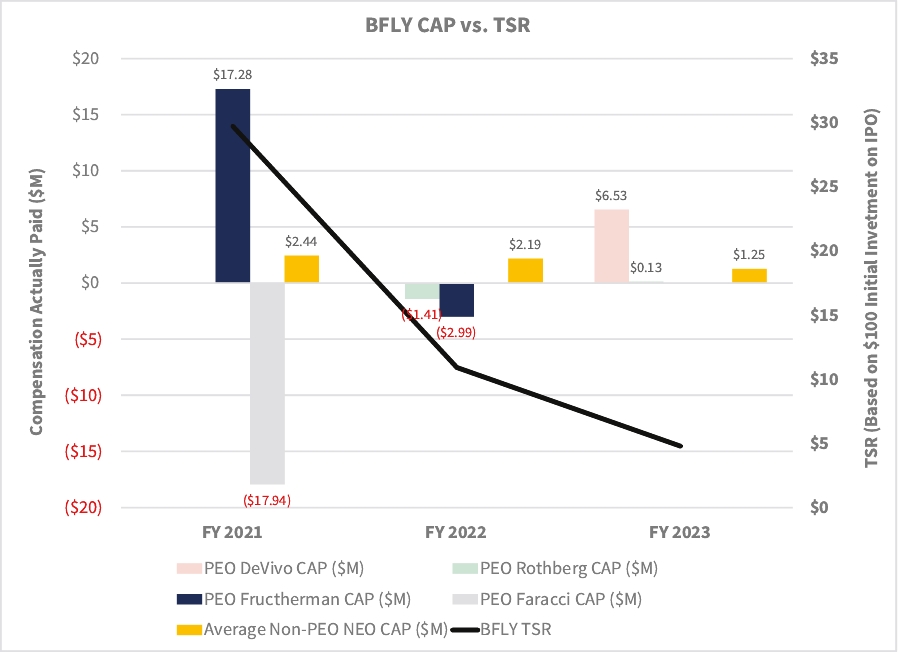

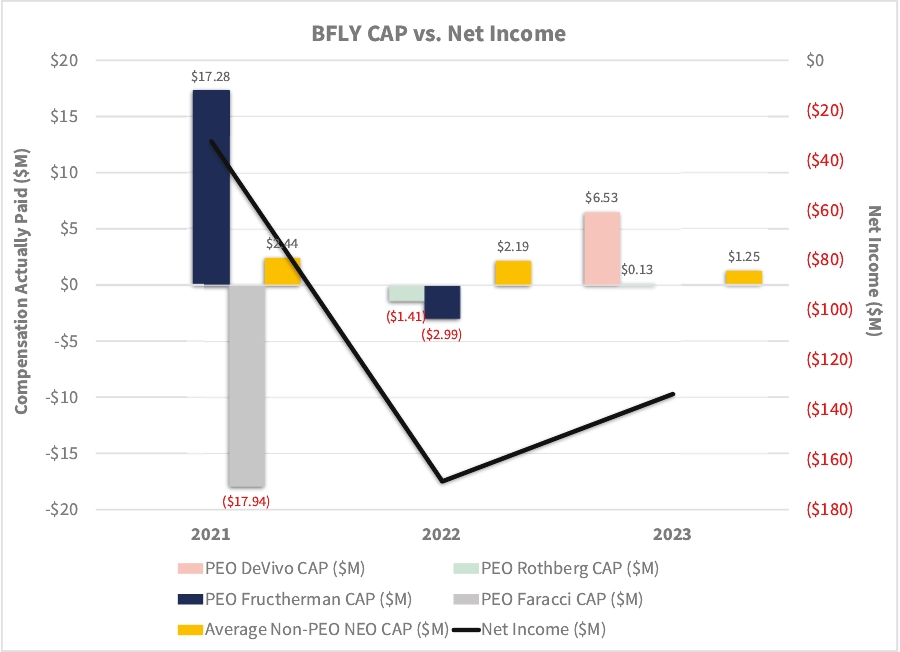

(2) | The dollar amounts reported in column (b) are the amounts of total compensation reported for our PEOs for each corresponding year in the “Total” column of the Summary Compensation Table. |

(3) | The dollar amounts reported in columns (c) and (e) represent the amount of CAP as computed in accordance with SEC rules. CAP does not necessarily represent cash and/or equity value transferred to the applicable NEO without restriction, but rather is a value calculated under applicable SEC rules. We do not |

| Fiscal Year | | | | | SCT (a) | | | Grant Date Value of New Awards (b) | | | Year End Value of New Awards (i) | | | Change in Value of Prior Awards (ii) | | | Change in Value of Prior Awards Vested (iii) | | | Value of New Awards Vested (iv) | | | Change in Value of Canceled Awards (v) | | | TOTAL Equity CAP (c)=(i)+(ii) +(iii)+ (iv)+(v) | | | CAP (d) =(a)- (b)+(c) | |

| 2023 | | | PEO1 | | | $10,808,618 | | | $9,117,333 | | | $2,912,000 | | | — | | | — | | | $1,928,000 | | | — | | | $4,840,000 | | | $6,531,285 |

| | | PEO2 | | | $217,351 | | | $149,999 | | | $71,052 | | | ($6,054) | | | ($5,262) | | | — | | | — | | | $59,737 | | | $127,089 | |

| | | PEO3 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | PEO4 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | Non-PEO NEOs | | | $2,779,468 | | | $1,968,000 | | | $797,917 | | | ($523,556) | | | ($104,291) | | | $273,125 | | | — | | | $443,194 | | | $1,254,662 | |

| 2022 | | | PEO1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | PEO2 | | | $217,498 | | | ($149,998) | | | $118,648 | | | ($37,106) | | | ($1,561,416) | | | — | | | — | | | ($1,479,874) | | | ($1,412,374) | |

| | | PEO3 | | | $6,640,611 | | | ($3,645,155) | | | — | | | — | | | ($4,873,998) | | | — | | | ($1,109,562) | | | ($5,983,560) | | | ($2,988,104) | |

| | | PEO4 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | Non-PEO NEOs | | | $3,340,627 | | | ($2,356,798) | | | $1,446,322 | | | ($189,039) | | | ($54,046) | | | — | | | — | | | $1,203,236 | | | $2,187,065 | |

| 2021 | | | PEO1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | PEO2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | PEO3 | | | $34,816,164 | | | ($29,611,907) | | | $12,071,202 | | | — | | | — | | | — | | | — | | | $12,071,202 | | | $17,275,459 | |

| | | PEO4 | | | $3,541,800 | | | — | | | — | | | — | | | $6,021,275 | | | — | | | ($27,505,528) | | | ($21,484,253) | | | ($17,942,453) | |

| | | Non-PEO NEOs | | | $2,875,233 | | | ($1,762,952) | | | $692,140 | | | $145,508 | | | $491,318 | | | — | | | — | | | $1,328,966 | | | $2,441,247 |

Ms. Pugh | | | Termination by the Company without Cause or by the Executive for Good Reason ($) | | | Termination by the Company without Cause or by the Executive for Good Reason Within 12 Months Following a Change in Control ($) |

Severance benefits: | | | | | ||

Severance payment | | | 480,000 | | | 816,000 |

Healthcare benefits | | | 16,800 | | | 16,800 |

Acceleration of equity awards: | | | | | ||

Market value of equity vesting on termination(1) | | | — | | | 1,389,245 |

Total Payment | | | 496,800 | | | 2,222,045 |

(b) | The grant date fair value |

| | |

(c) | The recalculated value of equity awards for each applicable year includes the addition (or subtraction, as applicable) of the following: |

| (i) | the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; |

| (ii) | the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; |

| (iii) | for awards granted in prior years that vest in the applicable year, the change in the fair value as of the vesting date from the beginning of the applicable year. |

| (iv) | for awards granted in the applicable year that vest in the applicable year, the fair value as of the vesting date. |

| (v) | for awards that are cancelled in the applicable year, the fair value of awards from the beginning of the applicable year. |

(4) | The dollar amounts reported in column (d) are the average amounts of total compensation reported for the other Non-PEO NEOs for each corresponding year in the “Total” column of the Summary Compensation Table. |

(5) | TSR determined in column (f) is based on the value of an initial fixed investment of $100 as of IPO on February 16, 2021. |

(6) | The amounts in this column reflect net income as reported in the company’s Consolidated Statements of Operations and Comprehensive Loss in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023. |

| 2024 Proxy Statement | | | 34 |

|

|

| 2024 Proxy Statement | | | |

Dr. Stoica | | | Termination by the Company without Cause or by the Executive for Good Reason ($) | | | Termination by the Company without Cause or by the Executive for Good Reason Within 12 Months Following a Change in Control ($) |

Severance benefits: | | | | | ||

Severance payment | | | 330,000 | | | 660,000 |

Healthcare benefits | | | 12,600 | | | 16,800 |

Acceleration of equity awards: | | | | | ||

Market value of equity vesting on termination(1) | | | — | | | 413,429 |

Total Payment | | | 342,600 | | | 1,090,229 |

Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1) ($) | | | Option Awards(2) ($) | | | All Other Compensation ($) | | | Total ($) |

Jonathan Rothberg, Ph.D., Chairman | | | 55,354 | | | 296,033 | | | 150,338 | | | — | | | 501,725 |

Dawn Carfora | | | 50,792 | | | 296,033 | | | 150,338 | | | — | | | 497,163 |

Elazer Edelman, M.D., Ph.D. | | | 52,644 | | | 299,997 | | | 150,338 | | | — | | | 502,979 |

John Hammergren | | | 57,417 | | | 296,033 | | | 150,338 | | | — | | | 503,788 |

Gianluca Pettiti | | | 66,250 | | | 296,033 | | | 150,338 | | | — | | | 512,621 |

S. Louise Phanstiel | | | 68,458 | | | 296,033 | | | 150,338 | | | — | | | 514,829 |

Larry Robbins | | | 48,583 | | | 243,405 | | | 150,338 | | | — | | | 442,326 |

Erica Schwartz, M.D., J.D., M.P.H. | | | 18,049 | | | 299,995 | | | — | | | — | | | 318,044 |

| Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1)(2) ($) | | | Option Awards(2) ($) | | | All Other Compensation ($) | | | Total ($) |

| Dawn Carfora | | | 58,017(3) | | | 149,999 | | | — | | | — | | | 208,016 |

| Elazer Edelman, M.D., Ph.D. | | | 65,000 | | | 149,999 | | | — | | | — | | | 214,999 |

| John Hammergren | | | 4,452(4) | | | — | | | — | | | — | | | 4,452 |

| Gianluca Pettiti | | | 72,782(5) | | | 149,999 | | | — | | | — | | | 222,781 |

| S. Louise Phanstiel | | | 77,500 | | | 149,999 | | | — | | | — | | | 227,499 |

| Larry Robbins | | | 71,855(6) | | | 149,999 | | | — | | | — | | | 221,854 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | 62,648(7) | | | 149,999 | | | — | | | — | | | 212,647 |

(1) | These amounts represent the aggregate grant date fair value of stock awards granted to each director in |

(2) |

| Name | | | Total Options Outstanding | | | Vested Options | | | Unvested RSUs |

| Dawn Carfora | | | 21,645 | | | 21,645 | | | 70,176 |

| Elazer Edelman, M.D., Ph.D. | | | 21,645 | | | 21,645 | | | 70,823 |

| John Hammergren | | | — | | | — | | | — |

| Gianluca Pettiti | | | 21,645 | | | 21,645 | | | — |

| S. Louise Phanstiel | | | 21,645 | | | 21,645 | | | 70,176 |

| Larry Robbins | | | 21,645 | | | 21,645 | | | 70,176 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | — | | | — | | | 73,757 |

(3) | Ms. Carfora’s fees are partially prorated as a result of |

(4) | Mr. Hammergren’s fees are partially prorated as a result of his resignation from the board of directors in |

(5) | Mr Pettit's fees are partially prorated as a result of |

(6) | Mr. Robbin’s fees are partially prorated as a result of his addition to |

(7) | Ms. Schwartz’s fees are partially prorated as a result of her appointment as Chairperson of the |

Name | | | Total Options Outstanding | | | Vested Options | | | Unvested RSUs |

Jonathan Rothberg, Ph.D., Chairman | | | 21,645 | | | — | | | 532,309 |

Dawn Carfora | | | 21,645 | | | — | | | 13,157 |

Elazer Edelman, M.D., Ph.D. | | | 21,645 | | | — | | | 15,098 |

John Hammergren | | | 21,645 | | | — | | | 13,157 |

Gianluca Pettiti | | | 21,645 | | | — | | | 13,157 |

S. Louise Phanstiel | | | 21,645 | | | — | | | 13,157 |

Larry Robbins | | | 21,645 | | | — | | | 13,157 |

Erica Schwartz, M.D., J.D., M.P.H. | | | — | | | — | | | 23,904 |

Name | | | RSUs Granted (#) | | | Options Granted (#) | | | Grant Date | | | Grant Date Fair Value ($) |

Jonathan Rothberg, Ph.D., Chairman | | | 13,157 | | | — | | | 2/16/2021 | | | 296,033 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

Dawn Carfora | | | 13,157 | | | — | | | 2/16/2021 | | | 296,033 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

Elazer Edelman, M.D., Ph.D. | | | 15,098 | | | — | | | 3/11/2021 | | | 299,997 |

| | | | | 21,645 | | | 7/1/2021 | | | 150,338 |

| | |

Name | | | RSUs Granted (#) | | | Options Granted (#) | | | Grant Date | | | Grant Date Fair Value ($) |

John Hammergren | | | 13,157 | | | — | | | 2/16/2021 | | | 296,033 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

Gianluca Pettiti | | | 13,157 | | | — | | | 2/16/2021 | | | 296,033 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

S. Louise Phanstiel | | | 13,157 | | | — | | | 2/16/2021 | | | 296,033 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

Larry Robbins | | | 13,157 | | | — | | | 3/10/2021 | | | 243,405 |

| | | — | | | 21,645 | | | 7/1/2021 | | | 150,338 | |

Erica Schwartz, M.D., J.D., M.P.H. | | | 23,904 | | | — | | | 9/9/2021 | | | 299,995 |

| Name | | | RSUs Granted (#) | | | Options Granted (#) | | | Grant Date | | | Grant Date Fair Value ($) |

| Dawn Carfora | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Elazer Edelman, M.D., Ph.D. | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| John Hammergren | | | — | | | — | | | — | | | — |

| Gianluca Pettiti | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| S. Louise Phanstiel | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Larry Robbins | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

Position | | | Retainer |

Audit committee chairperson | | | $20,000 |

Audit committee member | | | $10,000 |

Compensation committee chairperson | | | $15,000 |

Compensation committee member | | | $7,500 |

Nominating and corporate governance committee chairperson | | | $10,000 |

Nominating and corporate governance committee member | | | $5,000 |

Technology committee chairperson | | | $15,000 |

Technology committee member | | | $7,500 |

| | |

| | | (a) | | | (b) | | | (c) | |

Plan category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders | | | 38,700,000(1) | | | $8.11(2) | | | 17,000,000(3) |

Equity compensation plans not approved by security holders | | | — | | | — | | | — |

Total | | | 38,700,000 | | | $8.11 | | | 17,000,000(4) |

| | | (a) | | | (b) | | | (c) | |

| Plan category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders(1) | | | 23,009,170(2) | | | $6.17(3) | | | 27,248,959(4) |

Equity compensation plans not approved by security holders(5) | | | — | | | — | | | — |

| Total | | | 23,009,170 | | | $6.17 | | | 27,248,959(6) |

(1) | These plans consist of our 2012 Employee, Director and Consultant Equity Incentive Plan, or 2012 Plan, and our Amended and Restated 2020 Equity Incentive Plan, as amended, or 2020 Plan. |

(2) | Consists of (i) |

| Consists of the weighted-average exercise price of the |

| Consists of shares that remained available for future issuance under the 2020 Plan as of December 31, |

| We do not have any compensation plans that were not approved by shareholders nor have we granted any inducement awards. |

(6) | The 2020 Plan has an evergreen provision that allows for an annual increase in the number of shares available for issuance under the 2020 Plan to be added on the first day of each fiscal year, beginning in fiscal year 2021 and ending on the second day of fiscal year 2030. The evergreen provides for an automatic increase in the number of shares available for issuance equal to the lesser of (i) 4% of the number of outstanding shares of common stock on such date and (ii) an amount determined by the plan administrator. |

| | |

| | |

| | |

| | |

| | |

| | |

Fees | | | 2021 | | | 2020 |

Audit Fees | | | $1,849,000 | | | $1,736,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | 91,000 | | | — |

All Other Fees | | | — | | | — |

Total Fees | | | $1,940,000 | | | $1,736,000 |

| Fees | | | 2023 | | | 2022 |

Audit Fees(1) | | | $1,072,167 | | | $1,662,341 |

Audit-Related Fees(2) | | | — | | | — |

Tax Fees(3) | | | | | | 215,625 |

All Other Fees(4) | | | — | | | — |

| Total Fees | | | $1,072,167 | | | $1,877,966 |

Audit Fees. Audit fees consisted of audit work performed in the preparation of consolidated financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as quarterly review procedures and the provision of consents in connection with the filing of registration statements and related amendments, as well as other filings. |

Fees | | | 2021 | | | 2020 |

Audit Fees | | | — | | | $146,000 |

Audit-Related Fees | | | — | | | — |

Tax Fees | | | — | | | — |

All Other Fees | | | — | | | — |

Total Fees | | | — | | | $146,000 |

| (2) | Audit-Related Fees. This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” |

| (3) | Tax Fees. Tax fees consisted principally of tax consulting services. |

| (4) | All Other Fees. Our independent registered public accountants did not provide any products and services not disclosed in the table above during the fiscal years ended December 31, 2023 and 2022. As a result, there were no other fees billed or paid during those fiscal years. |

| 2024 Proxy Statement | | | 44 |

| | |

| | |

| 2024 Proxy Statement | | | 47 |

| 2024 Proxy Statement | | | 48 |

| | |

| a) | add a provision with respect to the automatic conversion of our Class B common stock effective February 12, 2028, which is seven years from the date of the closing of the Business Combination (the “Class B Conversion Amendment”); |

| b) | add a provision to provide for the exculpation of officers (the “Officer Exculpation Amendment” and collectively with the “Class B Conversion Amendment”, the “Charter Amendments”); and |

| c) | amend the exclusive forum provision (the “Exclusive Forum Amendment” |

| 2024 Proxy Statement | | | 50 |

| 2024 Proxy Statement | | | 51 |

| 2024 Proxy Statement | | | 52 |

| 2024 Proxy Statement | | | 53 |

| 2024 Proxy Statement | | | 54 |

| 2024 Proxy Statement | | | 55 |

| 2024 Proxy Statement | | | 56 |

| | |

| 2024 Proxy Statement | | | A-1 |

| 2024 Proxy Statement | | | A-2 |

| 2024 Proxy Statement | | | A-3 |

| 2024 Proxy Statement | | | A-4 |

| 2024 Proxy Statement | | | A-5 |

| 2024 Proxy Statement | | | A-6 |

| 2024 Proxy Statement | | | B-1 |

| 2024 Proxy Statement | | | B-2 |

| 2024 Proxy Statement | | | B-3 |

| 2024 Proxy Statement | | | B-4 |

| 2024 Proxy Statement | | | B-5 |

| 2024 Proxy Statement | | | B-6 |

| 2024 Proxy Statement | | | B-7 |

| 2024 Proxy Statement | | | B-8 |

| 2024 Proxy Statement | | | B-9 |

| 2024 Proxy Statement | | | B-10 |

| 2024 Proxy Statement | | | B-11 |

| 2024 Proxy Statement | | | B-12 |

| 2024 Proxy Statement | | | B-13 |

| 2024 Proxy Statement | | | B-14 |

| 2024 Proxy Statement | | | B-15 |

| | | LONGVIEW ACQUISITION CORPBUTTERFLY NETWORK, INC. | ||||

| | | By: | | | /s/ Mark Horowitz | |

| | | Name: Mark HorowitzJoseph DeVivo | ||||

| | | Title: Chief FinancialExecutive Officer | ||||

| 2024 Proxy Statement | | | B-16 |